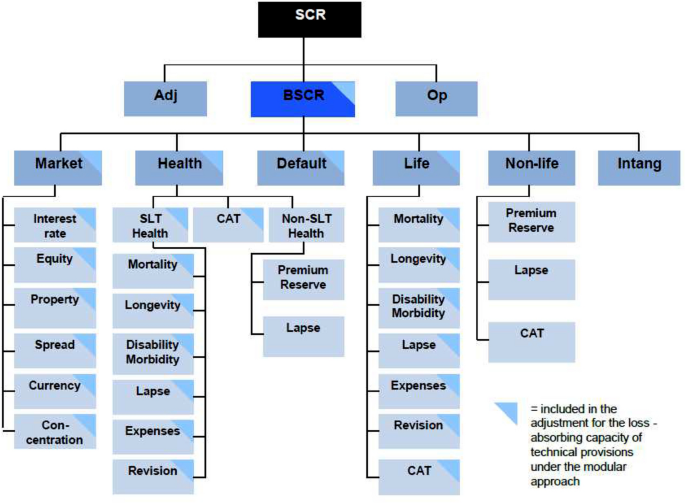

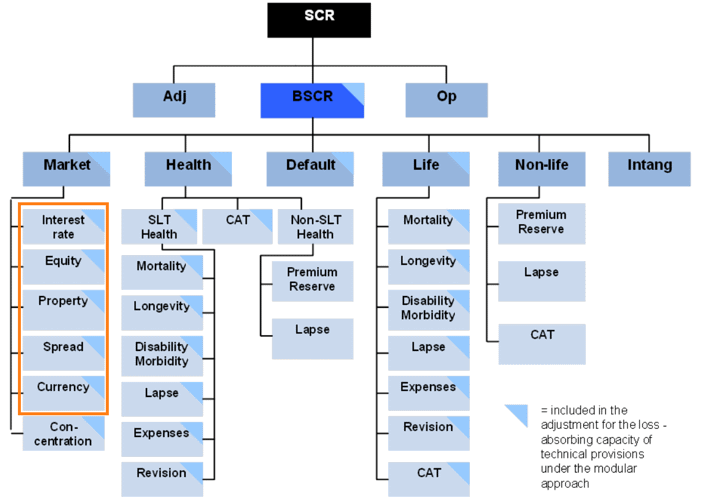

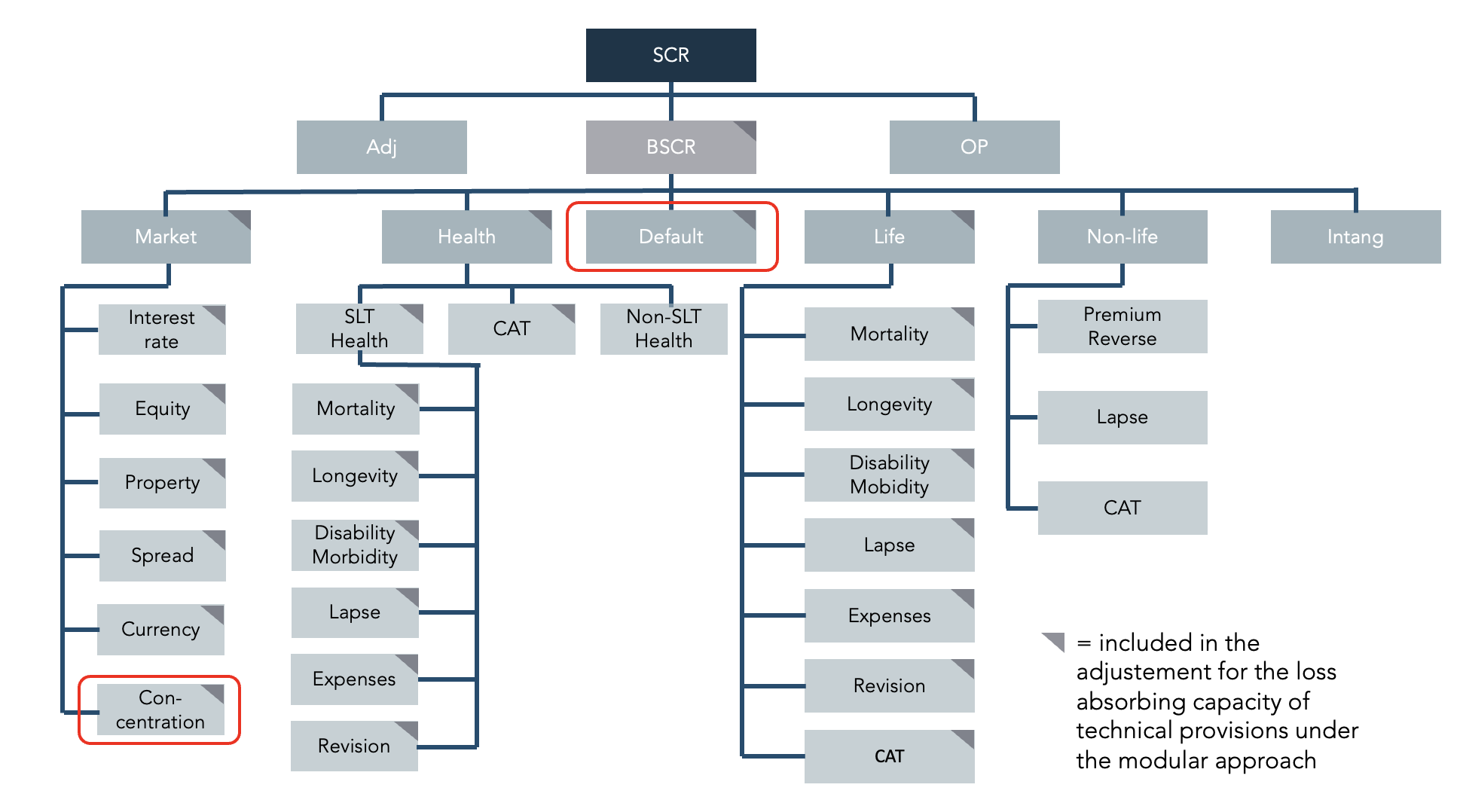

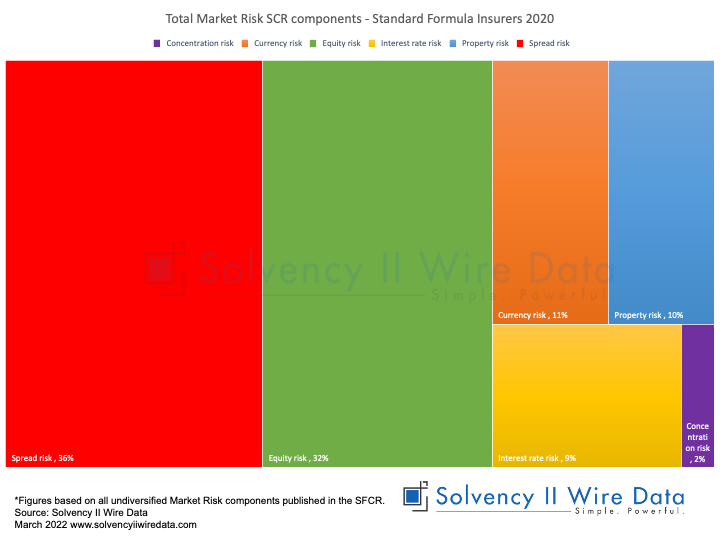

Insurance mathematics III. lecture Solvency II – introduction Solvency II is a new regime which changes fundamentally the insurers (and reinsurers). The. - ppt download

1. The overall structure of the standard formula | The underlying assumptions in the standard formula for the Solvency Capital Requirement calculation (EIOPA-14-322) | Better Regulation

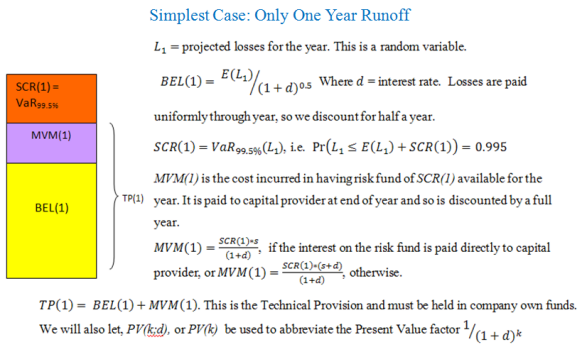

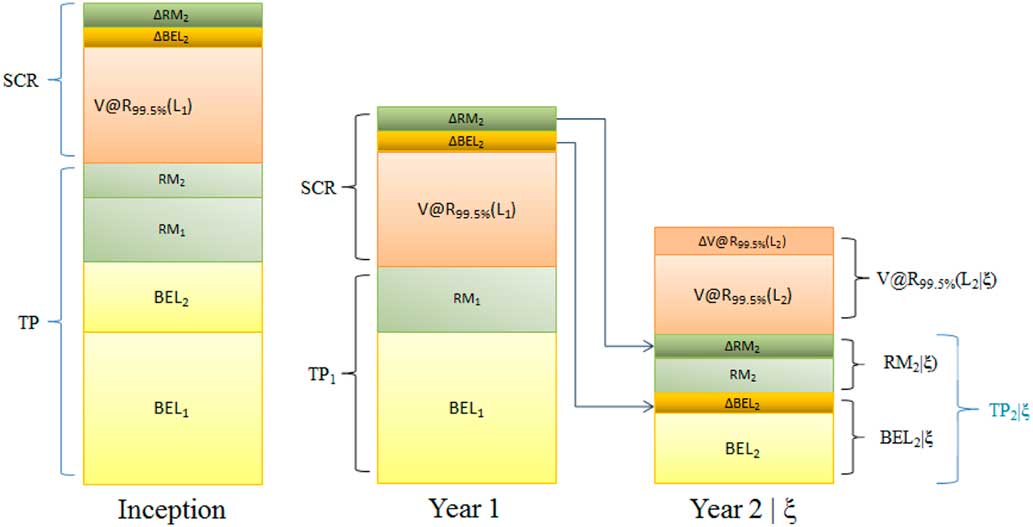

Solvency capital requirement and the claims development result | British Actuarial Journal | Cambridge Core

Article 178 Spread risk on securitisation positions: calculation of the capital requirement | Regulation 2015/35/EU - Solvency II Delegated Regulation | Better Regulation