PDF) Risk Based Approach to Calculate General Motor Insurance Reserve using High Performance Computing

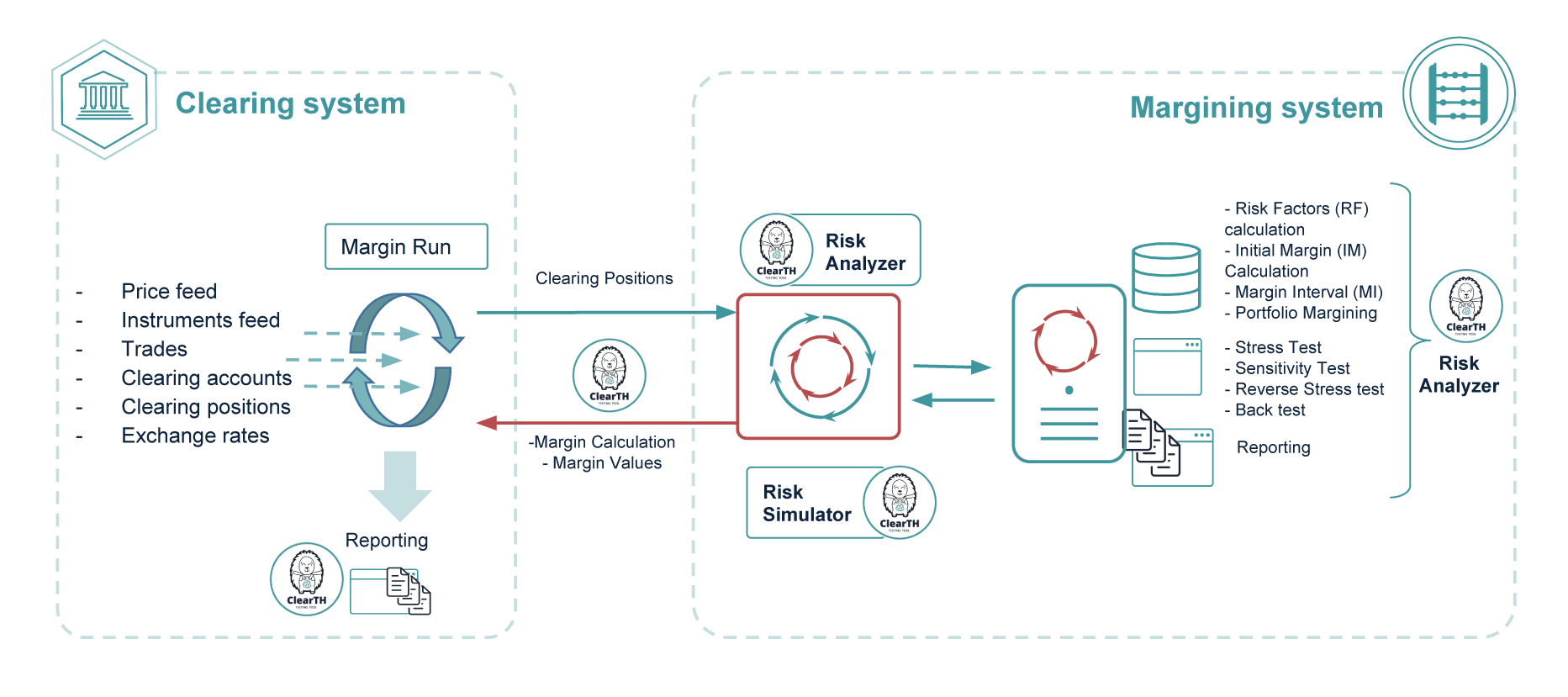

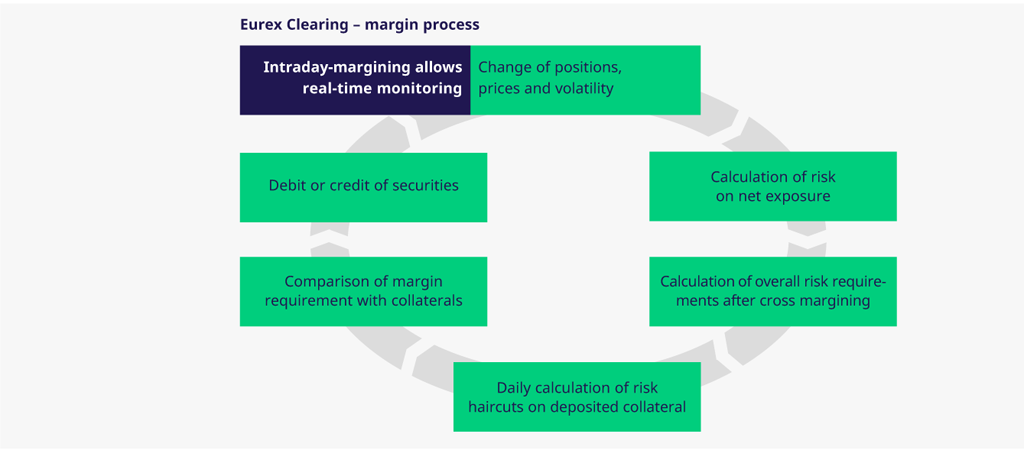

In this 2nd article, we explore how asset managers used margin forecasting and stress testing to manage collateral and liquidity risk during the mini-crisis in the UK Bond Markets.

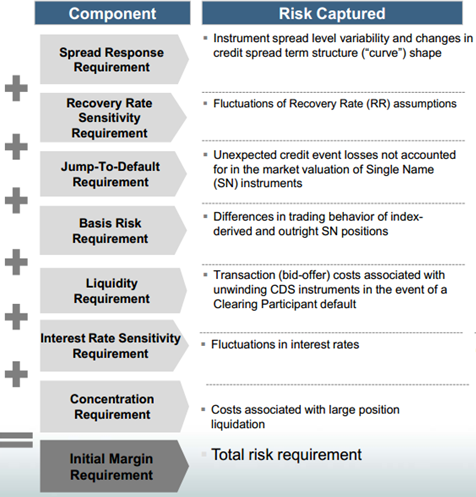

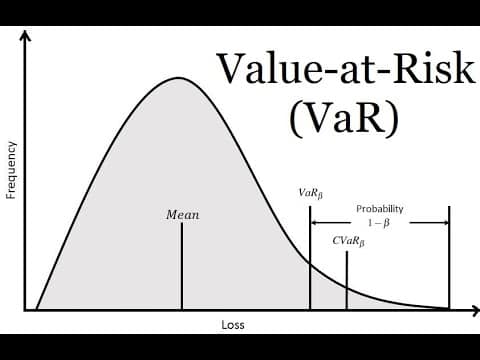

Margin Requirement Calculation Step 1 A = Initial Margin Multiplier * Risk Margin = 1.75 * Risk Margin Step 2 If the port has o

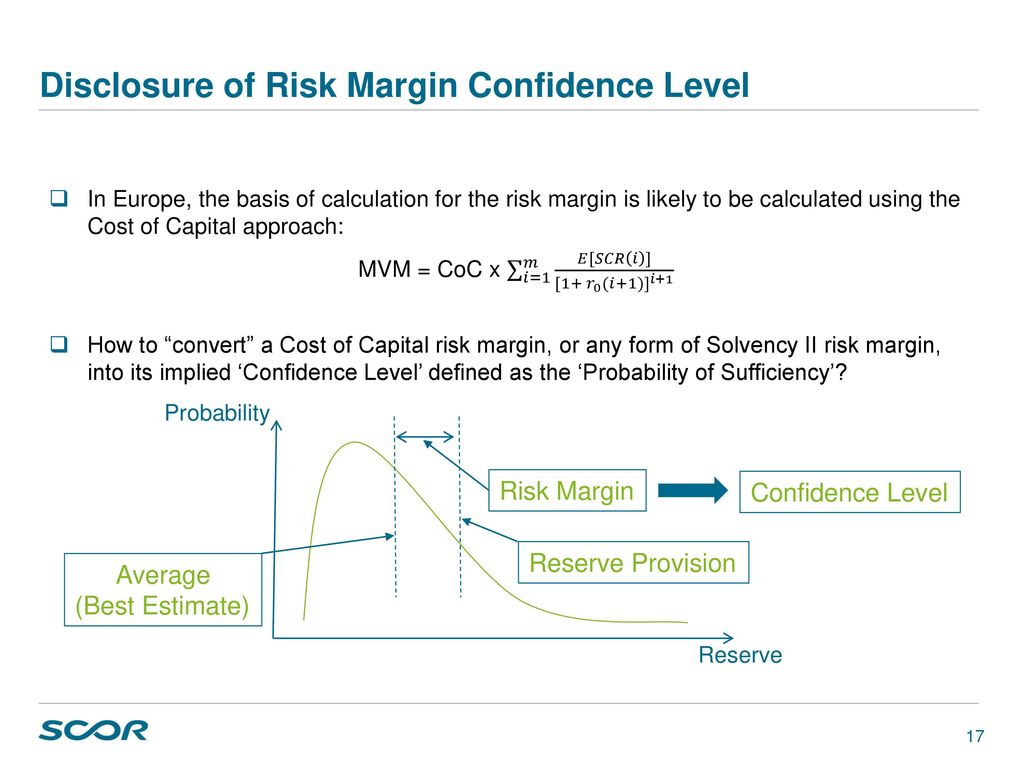

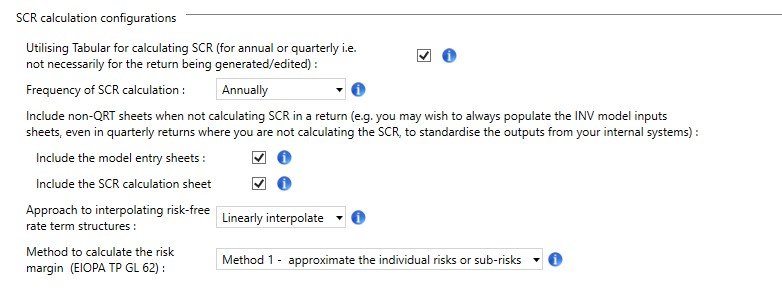

Solvency Assessment and Management: Steering Committee Position Paper 113 (v 3) The calculation of tax in technical provisions

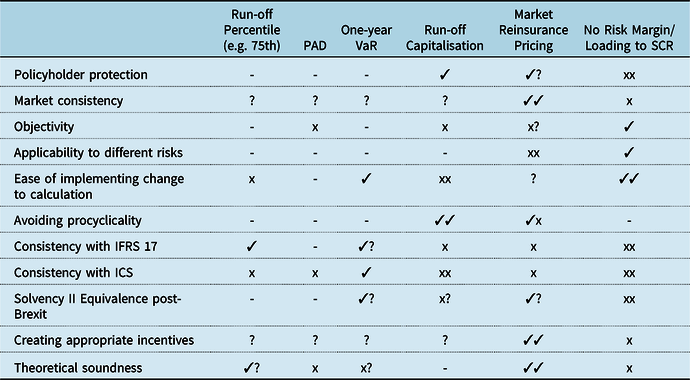

The Financial, Insurance & Investment Blog: Provision of Risk Margin for Adverse Deviation (PRAD) Models - Characteristics, Pros and Cons