GitHub - MBKraus/Solvency_II_Spread_Risk_Capital_Charge: Python script for calculating the spread risk solvency capital charge ("SCR") for a bond portfolio under Solvency II (along the standard formula)

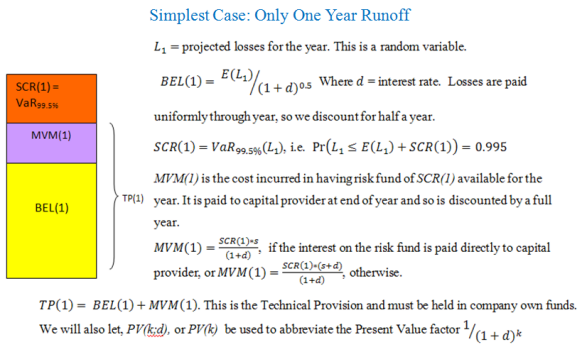

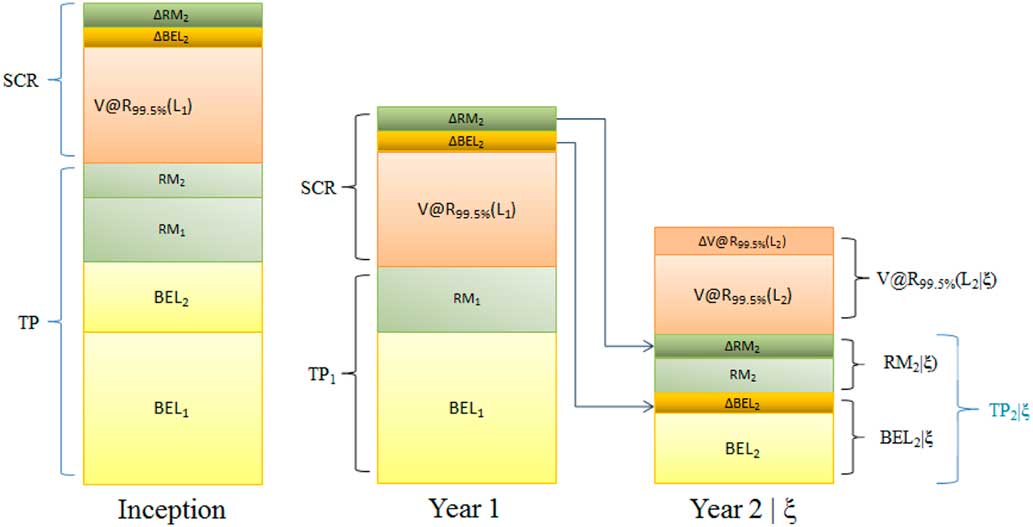

Solvency capital requirement and the claims development result | British Actuarial Journal | Cambridge Core

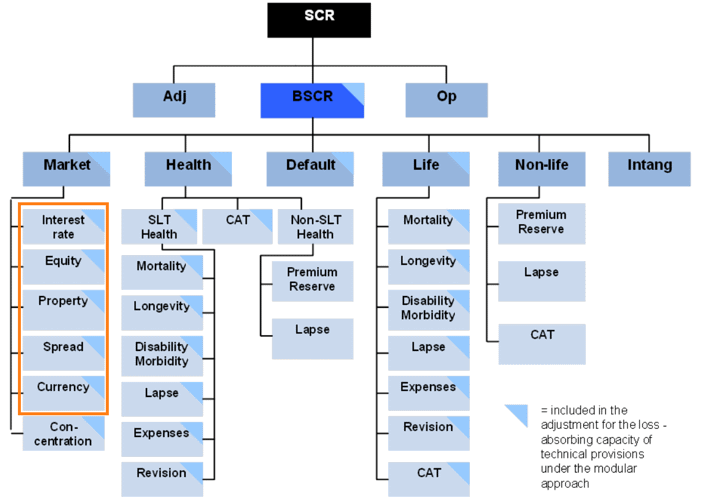

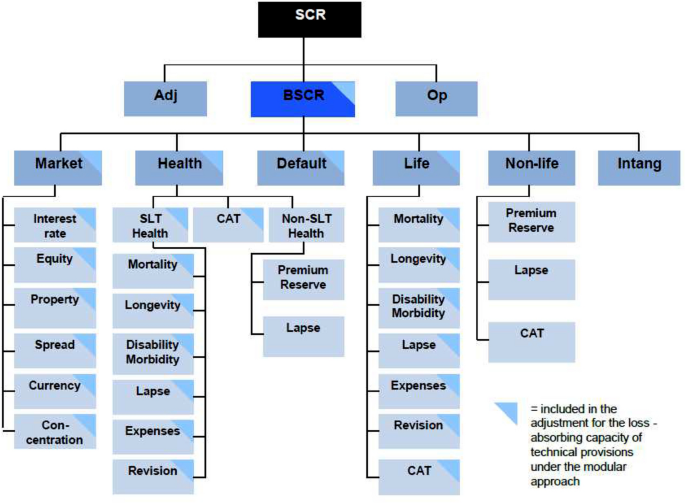

Solvency II Standard Formula Structure Source: European Insurance and... | Download Scientific Diagram

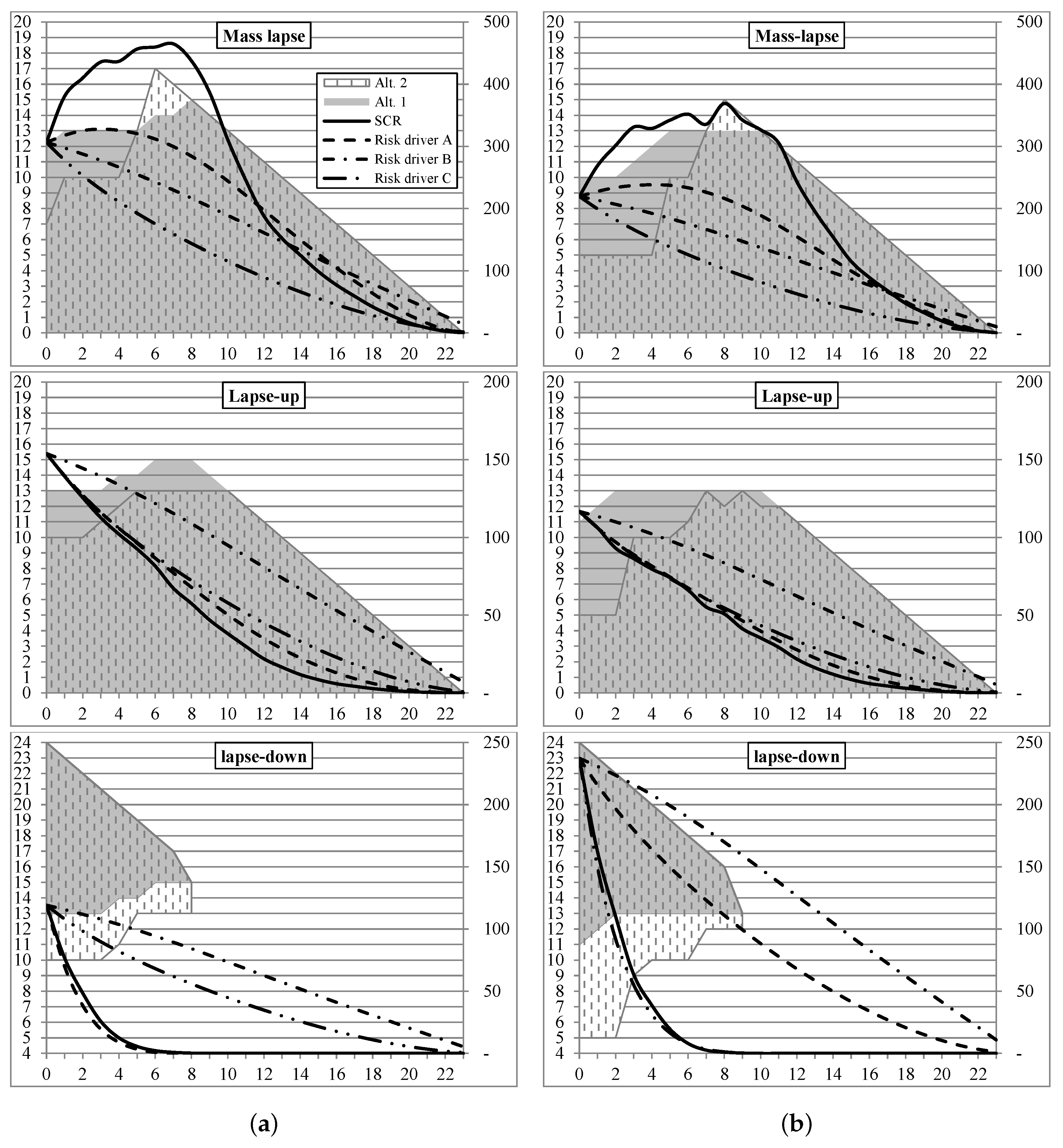

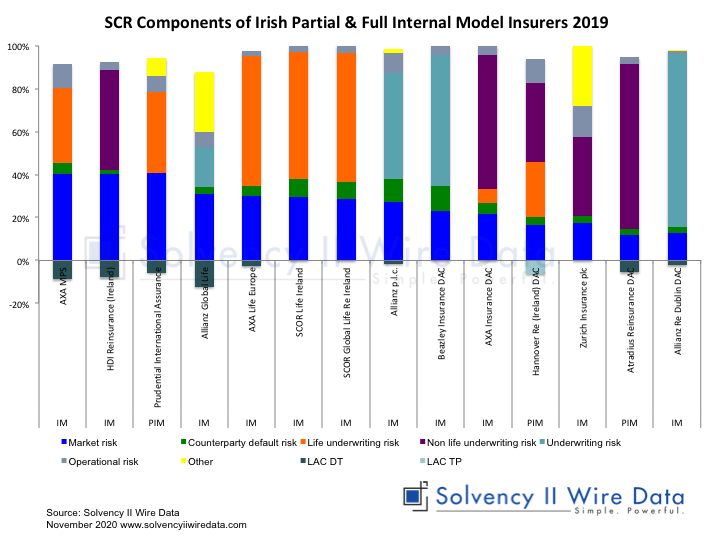

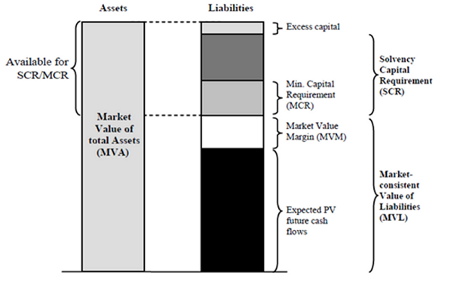

Quantifying credit and market risk under Solvency II: Standard approach versus internal model - ScienceDirect

An Analysis of Solvency II Standard Formula for Calculation of SCR , possible corrections and a comparison with an internal model | Semantic Scholar

1. The overall structure of the standard formula | The underlying assumptions in the standard formula for the Solvency Capital Requirement calculation (EIOPA-14-322) | Better Regulation